As the economy collapses, half a dozen Greeks try to build something that will save them from the country’s inevitable demise -and might even change the world.

I spent a few days in the offices of a Greek startup and found out what it is like to get funding from Silicon Valley and that failure can sometimes be a good thing.

(translated from the Greek -a shorter version of that story was published in the November, 2011 issue of Nitro, a Greek monthly)

(photos: Alexandros Ioannides)

Here’s what happens when you live next to the train tracks: Every discussion becomes harried and anxious in a subliminal, unconscious level. People speak a little faster, a little clearer, they make additional effort to be eloquent and precise because they know: An interruption is always lurking. Sooner or later, a train will pass by.

The office of gipht.me is located in Gazi, a district to the south of Athens’ center, right next to a sparkling underground metro station and the above-ground train tracks of the OSE, the maligned money-losing public railway company.

The office is a 200 sq. meter L-shaped apartment in the second floor of an old building with a decrepit facade (decades of graffiti and poster-plaster have covered it with a cake of urban filth impossible to remove) but a brand new elevator. On the floor above there is a Harley Davidson fan club. On the floor below, a dance studio. Few cars pass by Konstantinouloleos Street out front.

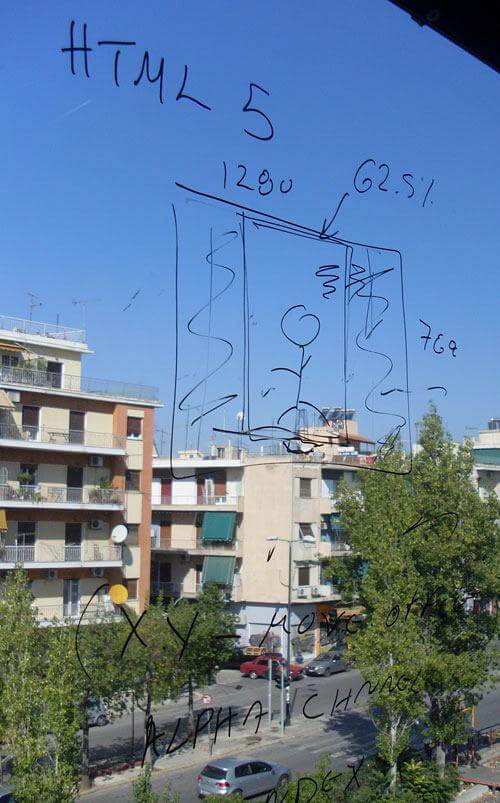

The longer side of the L-shaped apartment faces the street and the train tracks, and it is lined by large windows that let daylight shine through. The tenants have drawn lines of code, cute drawings and lyrics on the windows with magic markers. The floors are wooden and polished. Everything looks new.

There are usually about ten tenants -though their number varies. they are Greek programmers, designers and product managers and they make an application for smartphones that may revolutionize the way you communicate with your friends, but then again it may not. More on the tenants later -for now, let’s talk a little bit more about the office.

[motto_left]

The sole reason d’être of the room seems to be the collection of start-up clichés.

[/motto_left]

The entrance hall is a mostly empty space featuring an orange couch, a bench filled with toys and knick knacks (a remote-control car, a pair of tiny table tennis rackets), a brand new skateboard, a dart board filled with dart holes (three darts with flights in the colors of the Great Britain flag, three with flights flying American colors). The sole reason d’être of the room seems to be the collection of start-up cliches. To the right, a kitchenette and two bathrooms. To the left, a hallway and an enclosed office where lead developer and CTO Tassos Nousis has nested. He develops something fundamental and important -in all my visits, I would not set foot in that particular office.

The hallway leads to the living room, a large space with a large white L-shaped couch, two gray armchairs, a round coffee table with elaborate legs, four swirling chairs, a stack of red cardboard board game boxes that serve as a stand for a Mac Mini, a projector hung by a ceiling mount and a table. That’s where meetings and presentation take place. Also, the place where tenants take their meals, if they don’t want to eat at their desks.

The only room that actually does not have a view at the train tracks is the room where most of the gipht.me crew works. There is a tiny basketball board on the wall, and an even tinier plastic basketball to throw into it, when bored and restless. The crew’s desks are arranged in the shape of an L.

The most significant thing you notice when visiting the offices of gipht.me is this:

The train passes by rarely.

1.

Dimitris Hasapakis and Panagiotis Hatzidakis are friends since childhood. They grew up together in Pireaus, went to school together and ended up working together for most of their adult lives, first in their own company, then for an advertising agency. It’s a relationship straight out of a Randy Newman song, a lifelong affair that went through stages and ups and downs and eventually led to an evening in November, 2009, in Vouliagmenis Avenue, stuck in traffic, inside Dimitris’ car, when he turned to his friend and said:

“Wouldn’t it be nice if you could send something from your iPhone, say a box of cigars to a friend, and they receive it with a push notification?”

The things you need to know about Dimitris Hasapakis, a 35 year-old fast-talker who is built like a former wrestler who has let himself go a little and begins most of his sentences with “wouldn’t it be nice if”, are these:

When he was in high school, he decided that the best profession in the world is directing movies. So he went to the book fair by the waterfront in Pasalimani and bough every book on directing he could find, then borrowed some money from his parents and bought a gigantic Panasonic M40 VHS camera and, when he realized that his Amstrad 1640 was inadequate for his movie making, he found a friend with an Amiga and started shooting films.

[motto_right]

There are more people like that than you probably realize: The ones that must learn everything about anything they dabble in, who take things apart and set them back right again.

[/motto_right]

A couple of years later, still in high school, he realized that movie making was fine and all, but it was not very lucrative. The money, he decided, was in economics. So we went down to the book fair again and bought everything he could find on economics. But this was difficult stuff, not easy to digest. He had to find something else, something that would combine the creativity of directing with the real world of finance and money. Straight back to the book fair again, he bought everything there was to read about advertising. And he was hooked: He attended seminars, read the literature, even went to screenings of ads leading up to the Greek advertising awards, even though he hadn’t finished high school yet.

There are more people like that than you probably realize: The ones that must learn everything about anything they dabble in, who take things apart and set them back right again, only to gain full knowledge about them -and then abandon them forever. Dimitris Hasapakis is one of those people.

His hobby is SEO. It relaxes him to get websites to appear near the top of Google searches. He does it for fun. In 2008 he was filming a kettle of boiling water with Panagiotis (long story) and needed a soundtrack so he had YouTube play a clip of a Harry Potter movie and recorded the music. But every two minutes the clip would end and Dimitris would have to press play again. Most people would get frustrated and move on (most people would not be filming a kettle of boiling water, of course), but Dimitris saw a problem then and there, and he could not let it go that easily, so he wrote a script that would allow anyone to put any YouTube video on auto-replay ad infinitum. He named it Tube Replay (Google it -it comes up first). Mashable included it in a «Top-12 YouTube Hacks» list. At #1.

So when his wife Elena, who had just got his old iPhone and was learning how to use it asked if she could send a gift to a colleague of hers “who also has an iPhone”, Dimitris Hasapakis had an idea.

This idea would eventually become gipht.me, an application that allows you to send virtual gifts that look and behave like fun mini-applications to friends. The final product has been under development for a long time, and it is now nearing completion. Since that evening in Vouliagmenis Avenue a lot has changed. To get to this point it would take three very important things: Time, money and people.

2.

There was a pause that lasted a good two seconds after the dart left my hand. We looked at each other during that pause, then looked at the dart’s resting place, eight inches off the dartboard (not the center of the board -the board itself), then Panagiotis Chatzidakis said: “No one has ever thrown that thing this far before”.

Panagiotis is the art director of gipht.me and some sort of host in the office. He is the man who would fix my coffee every time (he remembered how I take it from my second visit on) and is a joyous fellow with a bellowing voice and striking good looks. He has appeared in commercials and television shows (he is hosting a DIY show starting December) but his main job is that of a designer.

“I started working with Dimitris in 1999”, he says, meaning Hasapakis, his childhood friend. “We had a company based in Pireaus called “Internet Services”, and we offered just that: Web design, internet hosting, everything”. It was the good old times of the internet bubble in Greece, when everyone was trying to get its business online even though few Greeks had access to the web and there was no market to speak of. “We provided our services in rock bottom prices”, says Dimitris Hasapakis, “but we had many costumers and were doing very well”.

“I started working with Dimitris in 1999”, he says, meaning Hasapakis, his childhood friend. “We had a company based in Pireaus called “Internet Services”, and we offered just that: Web design, internet hosting, everything”. It was the good old times of the internet bubble in Greece, when everyone was trying to get its business online even though few Greeks had access to the web and there was no market to speak of. “We provided our services in rock bottom prices”, says Dimitris Hasapakis, “but we had many costumers and were doing very well”.

In 2003 “Internet Services” decided to look into the issue of European funding. There were vast amounts of capital available to businesses at the time, businesses that had the time and the connections to tackle the labyrinthine bureaucracy, that is. The two friends had neither but, as it usually happens, Panagiotis’ girlfriend had a friend who was dating a Greek-American guy who “knew all about those things”. The guy’s name was -and, indeed, still is- Eric Parks. He was a law school graduate and had once helped some friends in Larissa set up an NGO, and had some experience with bureaucracy in Greece. He was the director of a construction company in the Former Yugoslavian Republic of Macedonia at the time, building cell phone towers on behalf of Greek telecommunications company Intracom.

The cup of coffee he had with Hasapakis and Chatzidakis in Pireaus would become a defining moment in their lives. During that afternoon they did not really talk that much about subsidies and applications and filings. The talked about something they discovered they had very much in common: Games

As it turned out, the three of them loved games, and not just video games, but all kinds of board games, role-playing, Magic The Gathering, the lot. After that meeting, and after Eric Parks decided that life in post-civil war FYROM was not all that safer than life in civil war FYROM, the three of them decided to branch out and create a new company that would build games. They called it “Typical Mutations”. Their first product was a board game called “Criminalita”. Building it taught them that a bookstore can claim up to 55% of a product’s retail price, while there were other important factors in the equation, namely storage, distribution deals, that sort of thing. They believed that there had to be a better way to build and sell games. They were right. There was. And they found it.

There next game began as a “wouldn’t it be nice if” idea by Dimitris Hasapakis, and one of his craziest ones at that: Wouldn’t it be nice if you could play a game on your TV with your DVD player?

At the time, no one knew if that was technically feasible. Each DVD player had access to the disk’s data -but could that data be displayed at random? That would be crucial if one wanted to create a trivia games -the questions would have to come up randomly. Dimitris was sure that it was possible -he was sure he had seen a movie with the ability to show scenes at random. And it was. Their game was called “Tilt” and was released just a few months after “Scene It!” was first launched. But they did not sell it to consumers: They sold it to Greek mobile carrier Cosmote, which used it to promote its new i-mode service. “It was then decided”, says Dimitris Hasapakis, “that we wouldn’t be creating just games, but interactive experiences for companies”.

They went on to create several of those, including an Internet adventure game called «The 5th Day» for Sony Ericsson that featured webisodes, a complicated storyline, and riddles that took place in the real world (players had to look for clues at a television Teletext page, or call a real restaurant on the telephone).

Their work, of course, did not go unnoticed at the advertising industry. Typical Mutations was eventually scooped up by Leo Burnett, and Eric Parks became the head of the company’s new digital department.

In 2006, Typical Mutations had created a web-based game called «Mystikes Selides» (“Secret Pages”). It is a very simple game: In each web page there is a riddle the solution of which is the URL of the next page. You have to solve all riddles to get to the end. Three years later, after most had forgotten that the game exists, a young fan called Giorgos Spanoudakis called them up with an interesting proposition:

Wouldn’t it be nice if we turned “Mystikes Selides” into a Facebook app?

3.

Giorgos Spanoudakis is a 27 year-old Greek , a former football player who got as far as the National U-15 squad. He got seriously injured at 15, though, and had to sit out almost two years, only to get seriously injured on his second game back and gave up his dreams of a professional career. The “president and co-founder” at gipht.me has had a journey quite atypical for a young Greek raised in the middle class of the late-90s/early ’00s. He was a good student even while he was playing football, and his injury forced him to focus on his studies further. He studied computer science at the University of Crete.

[motto_left]

In the fall of 2008, eight Greek lads moved to Palo Alto and lived together in a large house with a basketball court and a ping-pong table in the garage

[/motto_left]

In May 24, 2007 Facebook made a set of API available to developers worldwide. While Stanford University initiated a class for Facebook developers that very September, Nikolas Kokkalis, a Stanford PhD candidate, had an idea: He’d build commercial apps for Facebook, that was not yet the global juggernaut it is today, but was picking up steam very quickly. He had another idea: Instead of hiring programmers, he’d get talented Greek undergraduates to come to Palo Alto, only paying for their plane tickets and their accommodations. He sent an email to the two best universities in Greece, the Athens Polytechnic and the University of Crete, and waited. About 200 students expressed their interest -he chose eight. Giorgos Spanoudakis was one of them.

In the fall of 2008, eight Greek lads moved to Palo Alto and lived together in a large house with a basketball court and a ping-pong table in the garage, using a large van to get around in weekends and spending most of their time coding. They got separated into two groups, developing different applications. Their goal was to get an app installed by 1 million people within three months. Giorgos was in the team that was creating an app called “Perfect Match”. It got 3 million installations in one month.

“We employed a nifty trick”, says Giorgos. “To use the app, you had to share it with ten of your friends”. Thus, app spam was discovered.

As 2007 drew to a close, the initial group of students returned to Greece, but Giorgos remained. He helped recruit a new group of Greek students to continue the work. In this next batch were two of his former classmates in Crete: Tasos Nousis and Apostolis Chronakis.

[motto_right]

By the end of 2009, when thiinkle met Typical Mutations which was by then a part of Leo Burnett, Greek companies had started to realize the advertising potential of Facebook.

[/motto_right]

Life in Silicon Valley was great. The boys spent their days building apps, and hopped on their van on weekends and headed to San Francisco, an hour’s drive away. They spent Easter with 3000 Greek Americans at a traditional celebration in a Calistoga farm and took on the traditional Las Vegas road trip. When in school, Giorgos, Apostolis and Tasos weren’t friends (Giorgos and Apostolis didn’t even know Tasos existed). But in California they found that they have a lot in common and, more importantly, they can work together. On the way back from Vegas, they talked about creating their own company for the first time.

In the summer of 2008 Nikolas Kokkalis merged his company with another, and the Greek boys returned to Greece. The original plan was to keep working for Nikolas’ company from there, but that fell through. They set up a new company called thiinkle that would essentially do the same thing: Keep building popular Facebook applications, carefully sidestepping Facebook’s ever-more stringent rules, and earning enough money form advertising. The plan worked. Among the company’s hits was an app called “do you think…?”.

By the end of 2009, when thiinkle met Typical Mutations which was by then a part of Leo Burnett, Greek companies had started to realize the advertising potential of Facebook. The two companies started working together building Facebook apps for the advertising market.

Thus, the team was assembled: Eric, Dimitris, Panagiotis, Giorgos, Tasos and Apostolis were a group of disparate but complimentary personalities, awaiting an idea that would bring out their combined creativity in full.

The idea was there: It had been mentioned in that car in Leoforos Vouliagmenis.

There was something else they would need to make it happen: Money.

4.

The Benaki Museum in Pireos Avenue, is a remarkable building -it makes want to be a better person to deserve being in it. I visited it during the first truly chilling evening of the winter to witness the 43d Open Coffee, a gathering of the Greek startup scene.

There are two inaccuracies in the previous sentence. The term “startup scene” reminds one of “hip hop scene” or something similar, a characterization that denotes a cultural or sociological coherence that was nowhere to be seen during my visit. Also, an OpenCoffee is not something you witness, it is something you partake in. I was not prepared for that.

The concept, as founder Giorgos Tziralis explained, was born in 2007, when a British investor, complaining about his difficulty in locating individuals with great ideas to invest in, blogged that he would be at a particular Starbucks in London at a particular time next Thursday. Anyone wanted to talk to him, they would find him there. 75 people turned up.

Four months later, Tziralis, then 25 and a PhD candidate at Athens’ Polytechnic, decided to try something similar in Greece. The first Athens Open Coffee was held at a bookstore, attracted 15 people, and was deemed a success. Since then Open Coffee gatherings take place monthly in Athens and other Greek cities, and their participants number in the hundreds.

[motto_left]

In reality the startup economy is competitive and harsh. But its particular characteristics make it a unique part of the world’s economy.

[/motto_left]

The Open Coffee crowd is not as coherent as a business association or as a guild. Their common characteristic is their passion for ideas: They either have them or they are looking for them. Of course, ideas (and the monetization thereof) is what commerce is all about. But these particular entrepreneurs and investors are part of a particular subset of the economy that has some important and distinct differences and has come into being only after two important technological breakthroughs took place: Semiconductors and the internet. The first created a market for machines that were easy to assemble, powerful enough to undertake an unprecedented variety of tasks, and able to evolve at an astonishing speed. The second created a market for invisible products that were inexpensive to manufacture and yet had important value for users. These revolutions have led to the point in the financial history of the world where a kid with no money (or, at least, 99 dollars for a iOS developer license) and some free time can create something that millions of people can find useful and use. This, of course, is a rare occurrence -the stuff movies are made of. In reality the startup economy is competitive and harsh. But its particular characteristics make it a unique part of the world’s economy.

To understand the inner workings of this market and discover how it works in this country (if at all) I spoke with several the people who know it well. They are generally split in two categories: The creators and the investors. The creators are the people with ideas and the means to turn them into products. Investors are, as you might gather, the people eager to invest in those ideas, expecting healthy returns.

There does seem to be an abundance of ideas in Greece. Some examples: Spitogatos.gr is a real estate ads website that got serious funding from a local venture capital firm a few years ago. TaxiBeat is an iPhone and Android app that allows you to locate nearby taxis -and call them. i-Kiosk is a software and hardware solution for newsstand, kiosk, and mini-mart owners to streamline their operations. DailySecret is a daily newsletter of events and destinations that now serves nine cities from around the world. Bugsense is an app that allows programmers to debug their programs more efficiently.

Vasilis Nikolopoulos’ Intelen sells energy management services to companies and consumers. It raised 250.000 euros from Greek angel investors last month.

Dimitris Glezos’ Indifex from Patras sells a localization service for software creators.

Thessaloniki-born 18 year-old Apostolos Papadopoulos built 4sqwifi, an iPhone app that locates nearby WiFi hotspots and presents them on a list complete with their passwords, pulling the information off Foursquare tips. (When I looked for him for this article, I traced him in Silicon Valley, on a trip with other students from Germany, Switzerland and Austria).

And, if you want to stretch the definition of the term “Greek startup” a bit further, we could mention 31 year-old Tassos Argyros who, as a PhD candidate in Stanford, co-founded Aster Data, a data management and analysis company (used by MySpace and LinkedIn, among others) then sold it to its competitor, Teradata, for 263 million dollars.

These are only some examples that show the breadth of ideas coming out of Greece right now, from a small iPhone app like 4sqwifi to a large website like Spitogatos.gr.

I met «Spitogatos.gr» CEO Dimitris Melachrinos at his company’s headquarters, a 2nd floor office in Vouliagmenis Avenue, near the old Athens airport. His company existed a full 2,5 years before the funding came in. “We were a small company with a staff of 4”, he says, “but it is important that we weren’t a startup with a Powerpoint presentation. We had a product that works, the proof of concept was there”. After a year of negotiations, a venture capital firm called Oxygen Capital funded the company with the unheard-of amount of 750.000 euros. Two and a half years later, spitogatos.gr has 17 full time employees and has expanded its product -real estate listings- to include a social network for real estate agents, a website for vacation rentals, and other services.

Yet in these past 2,5 no other deals of that size have taken place in Greece. Oxygen Capital itself has turned its interests to other ventures and has not invested in tech since. I studied the second part of the start-up economy in Greece, the investors, and found that the money is there, but several factors prevent it from being funneled to actual products.

I met Kyriakos Pierrakakis, former president of the Youth Institute at the Ministry of Education who has studied startups from an unusual vantage point (and who now sits at the advisory board of gipht.me) and he explained how the market works over coffee in Kolonaki.

“Funding a start-up is a multi-stage process”, he said. “First comes seed funding, a small amount that helps an idea become a product. In Greece this amount may not even be necessary -most can scrape it up form their families. Then there is angel funding, during which individual investors fund the growth of the company with amounts that can reach a million euros. With notable exceptions, this stage does not exist in Greece. Venture capital firms in Greece are really large Private Equity firms that only invest large amounts of money”.

One of the most notable venture capital firms in Greece, for example, Attica Ventures, has invested in companies like Krokos Kozanis, Craft Beer and Mastiha Shop, pre-existing companies that produced unique Greek products and revived and rebranded with Attica’s investment. There are other examples -but none of them are investments in technology startups.

[motto_right]

The rules for businesses in Greece are not set in stone -they are written on a blackboard and are constantly modified and overturned, often without warning, notice or any conceivable logic.

[/motto_right]

There are three reasons for this: First, what creators repeatedly told me: Greek investors don’t understand technology. They cannot grasp the nuances of the startup economy -and thus cannot benefit from its opportunities. The second reason is something I’ve heard talked about from several sources: Investors are currently holding back, waiting for the economy to reach bottom. And there’s another reason: I may be wrong. Maybe there aren’t enough good ideas in Greece after all.

After the success of Open Coffee, Giorgos Tziralis helped found a small investment fund with money from Pireaus Bank and individual investors. OpenFund, as it is called, aims to fund new startups with small five-figure amounts. “In the two years OpenFund has been in operation we have received about 300 applications from over 40 countries”, he said to me. “About half of them are from Greek companies. We have proceeded with 8 investments, 4 of them with Greek founders”.

One would expect those numbers to be significantly bigger.

However, even though the money isn’t there, the startup market in Greece continues to grow. A German fund called HackFwd announced that it would start scouting the Greek scene (they give somewhat larger amounts) while new initiatives like STARTup Live Athens and an accelerator by Intelen’s Vasilis Nikolopoulos aim to educate teams of “creators” and help them grow.

Of course, this being Greece, there is a third important factor in place, one that is always present, even when it is unwelcome, which is almost always:

The state.

Here is why Greece is a terrible ecosystem for startups right now:

1. Taxes

Startup companies in the United States are mostly based in the state of Delaware, where principal capital is tax-free. Other countries offer “innovation hubs” for companies that get preferential treatment for a set period of time as an incentive to innovate (e.g. tax-free for three years, or until they become profitable). A 40-45% tax is a serious hurdle for any young entrepreneur.

2. Stability and bureaucracy

The rules for businesses in Greece are not set in stone -they are written on a blackboard and are constantly modified and overturned, often without warning, notice or any conceivable logic. Investor and entrepreneur Akis Tsoukalidis recited a harrowing list of procedures and details a businessman should know about and take care of if they want to do business in Greece. “Companies should be able to do simple things in an easy way. They should be able to file their travel expenses to the Tax Bureau, protect their innovations, even shut down quickly and easily. The way things are now, every company that want to innovate should either employ a department of counselors or deal with minutiae that have nothing to do with its core activities”.

3. Justice

According to Constitutional Law professor Stavros Tsakirakis, there are over 149.000 cases open at the Administrative Court in Athens. An administrative case can take over 17 years to resolve in the Greek courts as of today -and the number is rising. “Greece has the worst bureaucracy problem and the slowest justice system in Europe”, told me Kyriakos Pierrakakis. “Our numbers are worse than some African countries, actually”. This means that any investment in a company under Greek jurisdiction can get stuck in courts for decades in the case of a dispute.

4. You can’t get money from Silicon Valley

Large Venture Capital firms in the United Stated demand the physical presence of companies they fund in the Valley. The reasons range from the eccentric (Eric Parks told me of an investor who refuses to invest in companies based in areas beyond a set distance from his house) to the inexplicably practical (some firms even consider vehicle traffic in the company’s location among the factors among their investment models’ criteria).

Among these four factors, three are reversible (unless one could devise a way to solve Athens’ traffic overnight), and have been resolved successfully in several other nations. Remarkably, the model Greece could theoretically emulate is not Silicon Valley, nor smaller innovation centers in the United States like Austin, Texas or Boston, Mass. It’s Israel.

“Israel is a smaller country than Greece, imposes higher taxes, suffers from a crippling bureaucracy, has a homogenized population and is surrounded by about a billion enemies”, said Kyriakos Pierrakakis. “And yet, they have created the best technology ecosystem in the world outside the United States”.

Right now Israel has the most startups-per-capita on Earth. It has more companies on NASDAQ than Europe, Japan, Korea, China and India combined. Dan Senor’s «Start-up Nation: The Story of Israel’s Economic Miracle» explains the reasons that include the lack of natural resources, the large amount of immigrants and, above all, the experience in management a large percentage of the population receives during the obligatory army service.

Guess which other country has an obligatory army service.

I’m just saying.

As things stand, Greece is not a very hospitable place for startups. The best thing the country can expect to gain from this market is this scenario: Greek companies begin with seed funds from local initiatives or the founders’ own money, reach the proof of concept stage, then take it abroad to expand and grow, perhaps leaving part of their R&D department back in Greece if possible.

This scenario did not really fit gipht.me’s needs, however. Their product really did need more money to be completed. Each “gipht” is a mini app that needs to be designed, produced (with graphics and sound), developed and tested, a procedure that takes time and employs many talented people. They would have to have hundreds of “giphts” ready for launch, and that would take money.

The amount the guys were looking for (700.000 US dollars) fell right in the category that is almost non-existent in Greece.

“There were people with money in Greece” says Eric Parks who, as CEO and an experienced executive handled most of the negotiations when the company was looking for funding in the country. “Most of them were either taking it out of the country, or buying out troubled competitors, or investing in cheap real estate. At first, no one understood what we were doing. We weren’t getting answers to our e-mails. A friend advised as, in good nature, that if our chances of success were less than 46%, we should bet on the roulette table instead. So we decided to look for money elsewhere”.

Thus, gipht.me got up and left for Silicon Valley.

5.

On February 13th, 2011, Giorgos Spanoudakis travelled to Palo Alto for the second time in his life. He had a gipht.me presentation and an extensive business plane written by Eric -and no one else. He travelled alone, as the others had to stay back at their day jobs in the advertising company. The work he was going there to do would probably take months.

[motto_left]

“I found myself in the interesting position to have to write an email to a man offering us five million dollars, explaining why we respectfully must decline”

[/motto_left]

Giorgos had more than his prior experience to guide him. The Greek consulate in San Francisco is quite active in assisting Greek companies in the area. Mario Belibasakis, the vice consul and the man you need to know if you ‘re a Greek in the Valley (who also sent me a fascinating report he has prepared on how Greek companies can explore opportunities in the area) met with Giorgos and introduced him to some of the people that would help him down the road. Tassos Argyros of Aster Data was one of them.

Giorgos rented and apartment with a fascinating Sikh called Gurbrith, and started attending events and conferences in the area. He also rented a desk at Plug and Play Tech Center, a collaborative space.

This turned out to be important.

Plug and Play is owned by Saeed Amidi, a spectacular Persian who walks around the hallways his his velvety voice and his trademark vests, always a Coca Cola Light in hand, trying to introduce everyone to everyone. He runs Plug and Play as a collaborative office for start-ups and institutions around the world. Plug and Play itself does not invest in companies: It only provides them with a platform to meet investors and pitch their product. The goal is for deals to be made, money to change hands.

One of the things the guys back in Gazi had done right was the presentation. It was professionally made, beautiful to look at and brief, something one would expect by professionals in the advertising market, but which was a relative rarity in the tech world of Palo Alto. The people at Plug and Play began showing it around during their events because of that. In one of those events, a Ukrainian investor saw it, investigated further, and came up with an offer.

Of 5 million dollars.

For the entire thing. On the spot.

“He was absolutely serious”, said Eric Parks, “but his way kind of put us off. It was as if he weren’t exactly interested in the product, who we are, or what we plan to do with it. He approached it as an amusing novelty. So I found myself in the interesting position to have to write an email to a man offering us five million dollars, explaining why we respectfully must decline”.

As the weeks passed, Giorgos’ meetings became more serious and substantial. Two months later Eric came along, to participate in some of the more serious ones.

“We met the greatest VCs in the world” remembers Giorgos. “And we talked to some of their senior partners. We met George Zachary at CRV, one of the first investors (and member of the board) at Twitter. We did a presentation at Andreesen Horowitz, which was co-founded by Netscape creator Marc Andreessen. After our presentation his son, who is an angel investor, called us. He had heard his dad talk about us, and wanted to learn more about what we do”.

“It was an incredible experience, doing a presentation at Sequoia Capital“, says Eric, referring to the best known Venture Capital firm in the Valley, one that has funded some of the greatest companies in technology, from Google and Apple (in 1978!) to PayPal and Oracle. “Its headquarters are in Menlo Park, a subtle two-story building amongst the trees, and you go there and you meet a guy and he is very well prepared, he has read everything we have sent beforehand, and he listens intently, and makes timely questions and says “what you are doing is amazing” and you believe him, and later you realize that this was the former CFO at PayPal and the first to invest in YouTube”.

A slight pause.

“Nine months earlier we were in Peristeri, and were told we might as well play our money on the roulette table”.

The money they were looking for, however, were not easy to raise. Without an actual product and a proof of concept, all they had was a nice presentation and a relatively solid business plan. For that, they asked for 700.000 dollars, and to run the project from Greece. It was difficult. They eventually managed to raise half that amount but got investors that could potentially offer them things that are more important than money.

I-free, a Russion mobile company, looking for new markets after the feature phone explosion fizzles out and Cherubic, a company owned by a Taiwanese investor who has already funded half a dozen successful mobile startups, can lead gipht.me into two vast markets: Russia and China. And there was a third important investor, a very well known American VC firm, which I was politely asked not to disclose.

Which is a shame.

6.

Eric T. Parks (“T” does not stand for “Tiberius”, I asked) is a 36 year-old Greek American., His regular facial expression is one of bemused inquiry, and his frequent laughter matches his portly physicque, making him look a lot like a very young Santa Claus. He smokes an odorless pipe and can talk for hours on a vast variety of subjects. Most intelligent humans speak in well formed, complete sentences. Eric Parks speaks in paragraphs.

[motto_right]

There have been several start-ups that began with an idea that focused on the user experience and the quality of the service -and let actual monetization strategy for later.

[/motto_right]

He is an advertising executive, among the best known in the market, and yet his route there has been, to say the least, bizarre. After finishing Law School he practiced law in Denver Colorado until he decided that this was not, in fact, his calling, and attempted to return to Greece. He ended up working in Albania and Macedonia for a while, where he had the chance to see the muzzle of a very loaded AK-47 in the hands of a man who seemed to have some experience in trigger-pulling. Those were rough times in the Balkans. These things happened.

How, after all that, he ended up making online games and heading the digital division of a major advertising agency (and then pitching ideas at Sequoia Capital) makes no sense whatsoever, until you sit down and talk with him, and then suddenly everything sort of makes absolute sense.

As we discuss the app itself and the idiosyncrasies of the startup market in the office’s living room, Giorgos Spanoudakis sketches marketing ideas in an A4 pad. The thumps and yells inside mean that the boys are at it on the basketball board again.

Here are the individual characteristics of the start-up market, the three things that really set it apart from the rest of the economy.

1) The barrier of entry is very low

A company does not need expensive machinery or a factory or materials, or storage or any of those things. Even complicated software projects like gipht.me can be brought to market in a fraction of the price “real economy” products cost.

2) You don’t have to know how you’ll make money

There have been several start-ups that began with an idea that focused on the user experience and the quality of the service -and let actual monetization strategy for later. Facebook began like that -Twitter still doesn’t have a clear path to significant revenue.

3) It doesn’t matter if you fail.

The first point is easily understandable, and we’ll talk about the third later on, but let’s focus on the second part for a bit: While some start-ups don’t have clear monetization strategies, gipht.me has three.

“99% of “giphts” will be free”, says Eric Parks, “but some premium giphts will cost money. People are now used to buying this sort of virtual goods if they are priced moderately and have demonstrable value. We have seen it happen, and we aim to achieve it here as well. So there’s one source of revenue. At the same time we’ll have two APIs, one for developers who want to use our platform for their apps, and one for publishers who want to create their own “giphts”. From the sale of those, we get a cut. And there is a third source of revenue, the most important one in my opinion: Sponsored giphts. From our experience in the advertising market we have discovered that there is a great need for immersive advertising experiences. No one has found a way to deliver this type of service in the mobile field. We think gipht.me can cover this gap in the market”.

Besides the six co-founders who own equity, gipht.me has half a dozen employees (designers, sound engineers, IT personnel) as well as an advisory board that helps operation in various ways. Kyriakos Pierrakakis is a member of the board -Tassos Argyros, the 31 year-old who sold Aster Data for 263 million is another.

“There are few really good software companies in Greece right now”, wrote Argyros in an email. “Whenever I find one I study it carefully and help accordingly. I believe that the support of such ventures is great for the country”.

As I write this the guys are building “giphts” in a frenzied pace. Tasos Nousis has just concluded a major upgrade in the platform’s backbone and now it’s all about creating enough “gihpts” to make the app appear full and busy at launch.

The app will first come out on the iPhone App Store and then versions for Android, Windows Phone, Blackberry and even Samsung’s Bada will follow.

Because users will be able to send “giphts” to smartphones of different operating systems and of different screen sizes, the team has decided to build them in HTML5, a decision that brought many great challenges with it. There was no complete prototype to try at the time of writing, so I tested the app’s UI on the iOS preview of Tasos Nousis’ Macbook and then saw some of the “gihpts” on Apostolis Chronakis’ iPhone4.

Each “gihpt” is essentially a tiny website that actually lives on the internet without the user actually knowing it. There is no browser page and the whole user experience resembles that of a native app’s. I tried a gihpt that shows a DJ deck and plays music. You can scratch the disk on the deck, obviously. Another gipht showed a giddy cartoon baby. You’d tickle it, and it’d laugh. There are mini games and romantic e-cards and Christmas-themed giphts. There are giphts that will only do something when you’re in a particular venue -say, a Starbucks-, sort of an anti-Foursquare thing. All of them are very polished and much more complicated than I expected. Consider this: You will receive such “giphts” as you receive SMS messages.

Very soon the app will be on the App Store and my question is: What happens next? Will people download it? Will they send giphts to their friends? What if they don’t? What if they download it and, as I have done with literally hundreds of apps in the past few years, open it once and then forget it forever?

“The team has built products that have been used by 23 million people”, says Eric Parks. “We know how to bring people on a new platform. We have done it many times. What we need to focus on is making them stay. There are many factors that determine whether they will. We put a lot of emphasis in data mining, to truly understand how users will use our platform and make the necessary adjustments”.

And, of course, there is that third attribute of the start-up economy:

Failure is not a bad thing

[motto_left]

The app will first come out on the iPhone App Store and then versions for Android, Windows Phone, Blackberry and even Samsung’s Bada will follow.

[/motto_left]

On the contrary. In the start-up market failures are accolades, signify experience, they are unavoidable steps in an entrepreneur’s path to greatness. This is something both “creators” and “investors” should know. It is a matter of statistics, it’s mathematics: Out of ten start-ups that receive funding and create a product, seven ultimately fail. Two manage to break even. And there is one that makes enough money to cover the losses of everybody else, and make this market worthwhile. This is why Silicon Valley investors fund as many good ideas as they can with relatively small sums. This is why creators approach failure this non-chalantly.

Because start-up entrepreneurs don’t have debt, there is no stock merchandize, there are no loans outstanding. They get paid to try by people who have the luxury to risk. And the more they fail, the better they get, and the odds of an eventual win get better all the time.

These six guys in Gazi may make something amazing that will solve their financial situation forever, or they may end up with a decent up that can pay for itself, or they can fail to raise any more money, and give it up altogether. Don’t think that one of those scenarios is better than the others. The first one seems like it is, but it is not necessarily so. Perhaps the idea that will lead to a buy-out from Google or an IPO at NASDAQ is not gipht.me, but their next one. As I play with their giphts on Apostolis’ iPhone, I ponder how great it must be to work under this type of (well, how else can you call it but) freedom. And at that particular moment

a train passes by.

(Top, from left, Tasos Nousis, Eric Parks, Giorgos Spanoudakis. Bottom, from left: Panagiotis Hatzidakis, Apostolis Hronakis, Dimitris Hasapakis. Photos: Alexandros Ioannides)

UPDATE: Gipht.me was released on the App Store on December 23, 2011 (you can download it here).

[field id=”1″]